We'll take a quick look at the Elliott Wave charts of the NZDUSD currency pair in this technical blog. The pair has been showing bearish sequences in the cycle since the February 2021 peak, as our members are aware. The pair recently bounced three times, reaching our selling zone and providing us with solid trading possibilities. The Elliott Wave Forecast and trading approach will be discussed further in this article.

H1 Elliott Wave Analysis of the NZDUSD 05.11.2022

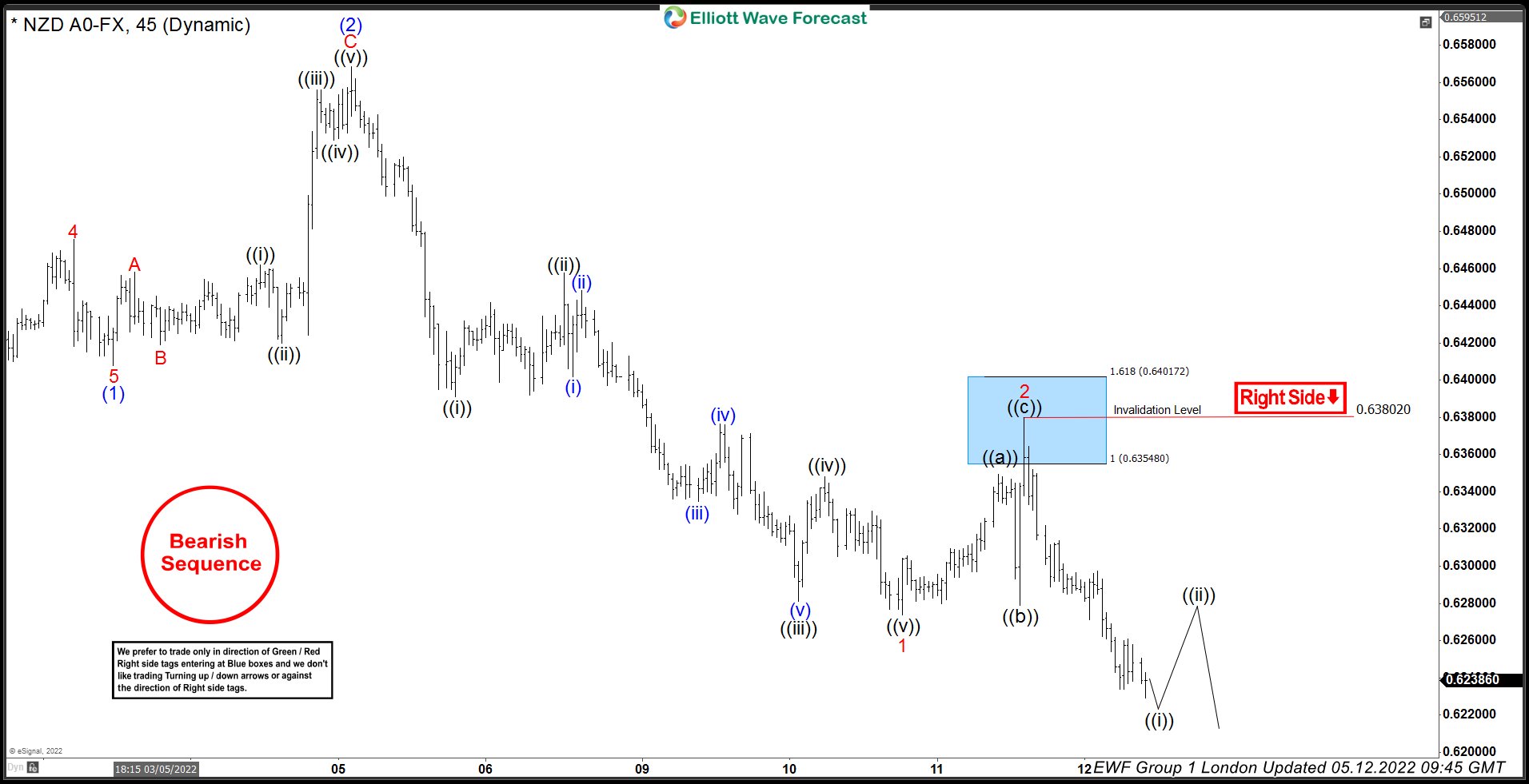

From the 0.65682 peak, the NZDUSD is correcting the cycle. To complete 2 red recovery, recovery has already reached the blue box at 0.63552-0.64021. We advised members to avoid purchasing the pair, as we like the blue box's short side. Selling the pair at the highlighted zone is the strategy. Breaking above 1.618 fibs extension: 0.64021 would invalidate the trade. We predict sellers to arrive in the blue box for at least three waves of pullback because the main trend is bearish. We will enter a risk-free short position (put SL at BE) and take partial profits whenever the pullback approaches 50 Fibs versus the ((b)) black low.

As our members know Blue Boxes are no enemy areas , giving us 85% chance to get a reaction.

Reminder: You can learn about Elliott Wave Rules and Patterns at our Free Elliott Wave Educational Web Page.

NZDUSD H1 Elliott Wave Analysis 05.12.2022

The pair found sellers at the blue box area: 0.63552-0.64021 and made turn lower from there. As a result , members who took short trades made positions risk free ( Put SL at BE) and took partial profits. We got a break toward new lows which makes the pair bearish against the 0.63802 peak in first degree. At this stage we see wave 2 red completed at the 0.6380 high. While mentioned pivot holds, the pair can keep finding intraday sellers in 3,7,11 swings for a further extension down.

Keep in mind market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences.We put them in Sequence Report and best among them are shown in the Live Trading Room.